The Rise of Functional Coffee Alternatives

The functional beverage market is experiencing unprecedented growth, driven by consumers seeking healthier alternatives to traditional coffee and energy drinks. At the forefront of this movement is Spacegoods, a UK-based startup that has raised over $3.1 million in seed funding to revolutionize how people think about their daily caffeine ritual.

Spacegoods markets its "rainbow dust" powders as complete coffee replacements, blending various mushroom species with adaptogens to deliver sustained energy without the jitters associated with conventional coffee. The company offers distinct product lines: day blends focused on energy, focus, and productivity, and night blends designed to promote calm and relaxation.

The ADHD Focus Market: A $25 Billion Opportunity

Spacegoods operates within a rapidly expanding niche: focus-enhancing beverages for individuals with ADHD or those seeking cognitive enhancement. The numbers tell a compelling story:

- ADHD therapeutics market: Currently valued at approximately $25 billion

- ADHD supplements market: Projected to reach $1 billion by 2032

- Social media engagement: 4.5 million TikTok posts about ADHD driving awareness

This convergence of medical need, supplement innovation, and social media amplification has created fertile ground for brands like Spacegoods, Neutonic, and Liquid Focus.

Market Segmentation

| Brand | Primary Positioning | Key Differentiator | Target Consumption |

|---|---|---|---|

| Spacegoods | Coffee replacement | Mushroom + adaptogen blends for day/night | Daily routine replacement |

| Neutonic | Energy drink alternative | Productivity-focused formulation | Pre-work/study sessions |

| Liquid Focus | Task-specific concentrate | Timed consumption (30 min before tasks) | On-demand focus boost |

China's Functional Beverage Landscape

While Spacegoods captures attention in Western markets, China has developed its own robust functional beverage ecosystem, driven by different cultural contexts and consumer preferences.

Leading Chinese Players

1. WonderLab Founded in 2019, WonderLab has become one of China's most prominent functional food brands, raising significant venture capital. While primarily known for meal replacement products, the company has expanded into functional beverages incorporating traditional Chinese medicine (TCM) ingredients like goji berries, lotus seeds, and various mushroom varieties.

2. Buffx Buffx positions itself as an energy management solution rather than simply an energy drink. The brand incorporates adaptogens and vitamins, targeting young professionals seeking sustained productivity without relying on excessive caffeine.

3. YEYO Coffee YEYO merges specialty coffee culture with functional ingredients, adding collagen, vitamins, and botanical extracts to ready-to-drink coffee beverages. This hybrid approach appeals to consumers unwilling to completely abandon coffee but seeking additional health benefits.

4. Nongfu Spring's Functional Line China's largest bottled water company has entered the functional beverage space with products containing electrolytes, vitamins, and energy-boosting ingredients, leveraging its extensive distribution network.

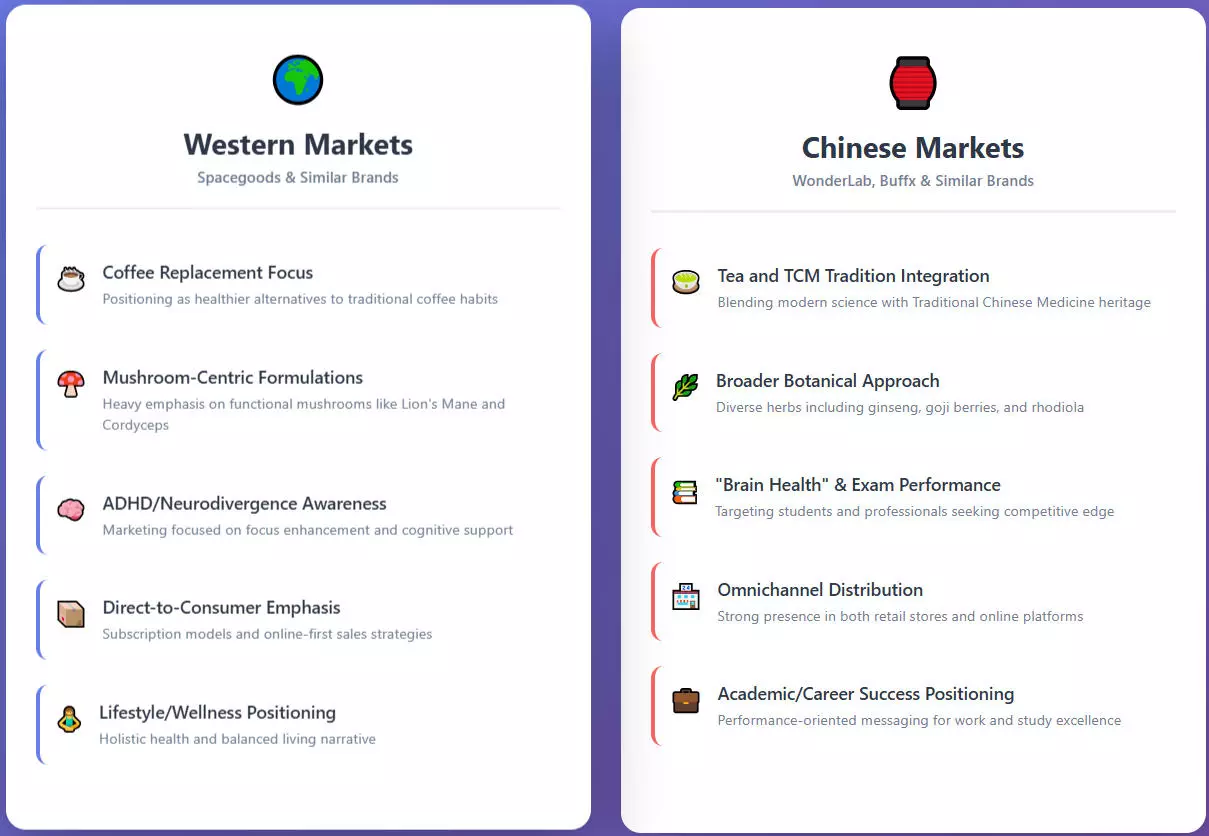

East-West Market Comparison

Ingredient Philosophy: Divergent Approaches

Spacegoods' Formula

The brand's flagship products contain:

- Lion's Mane mushroom (cognitive function)

- Cordyceps (energy and endurance)

- Chaga (immune support)

- Reishi (stress reduction)

- Ashwagandha and other adaptogens

- Maca root (hormonal balance)

Chinese Functional Beverage Ingredients

Chinese brands typically incorporate:

- Ginseng (energy and cognition)

- Goji berries (antioxidants and eye health)

- Rhodiola rosea (stress adaptation)

- Schisandra (mental performance)

- Astragalus (immune function)

- Various mushrooms (overlapping with Western products)

Notable overlap: Both markets have embraced adaptogenic mushrooms, though Western brands emphasize this more prominently in marketing, while Chinese brands integrate them within broader TCM frameworks.

Market Growth Projections

Global Functional Beverage Market

| Year | Market Size (USD) | Growth Rate |

|---|---|---|

| 2023 | $158 billion | - |

| 2025 | $183 billion | 7.7% CAGR |

| 2028 | $231 billion | 8.1% CAGR |

| 2032 | $312 billion | 7.8% CAGR |

Regional Market Dynamics

North America & Europe (Spacegoods' Primary Markets)

- Strong growth driven by wellness consciousness

- Premium pricing accepted for quality ingredients

- Direct-to-consumer models thriving

- Emphasis on transparency and clinical research

Asia-Pacific (Chinese Brands' Territory)

- Fastest-growing market globally

- Price sensitivity remains significant factor

- Retail distribution still crucial

- Integration of traditional and modern medicine

Consumer Demographics and Motivations

Western Consumers (Spacegoods Target)

- Primary age group: 25-40 years

-

Key motivations:

- Reducing coffee dependence

- Managing ADHD symptoms naturally

- Improving sleep quality (night blends)

- Sustainable energy without crashes

- Purchase drivers: Ingredient transparency, third-party testing, brand values

Chinese Consumers (Domestic Brands' Target)

- Primary age group: 20-35 years

-

Key motivations:

- Academic and career performance

- Gaokao (college entrance exam) preparation

- Managing work stress ("996" culture)

- Maintaining health despite demanding schedules

- Purchase drivers: Efficacy claims, brand reputation, convenience, taste

Challenges Facing Both Markets

Regulatory Hurdles

Western Markets: FDA and EFSA scrutiny of health claims, particularly around cognitive enhancement and ADHD management.

Chinese Market: Strict regulations on health food products requiring government approval; claims must be carefully worded to avoid classification as pharmaceuticals.

Consumer Skepticism

Both markets face questions about:

- Scientific evidence supporting ingredient efficacy

- Optimal dosing in beverage formats

- Long-term safety of daily consumption

- Whether benefits justify premium pricing

Competition Intensity

Spacegoods competes against:

- Established coffee brands launching functional lines

- Supplement companies entering beverages

- Energy drink giants reformulating products

- Other mushroom-based startups

Chinese brands compete against:

- Massive beverage conglomerates (Nongfu Spring, Uni-President)

- Traditional tea culture and TCM shops

- International functional beverage imports

- Each other in increasingly crowded market

Innovation and Differentiation Strategies

Spacegoods' Approach

- Taste parity: Promising coffee-like taste removes adoption barrier

- Dual-purpose formulations: Day/night system addresses multiple needs

- Educational content: Building community around mushroom benefits

- Subscription model: Recurring revenue and customer retention

- Premium positioning: Quality ingredients justify higher price point

Chinese Brands' Strategies

- Cultural integration: Connecting modern science with TCM heritage

- Convenience formats: Ready-to-drink products for on-the-go consumption

- Celebrity endorsements: Leveraging influencer marketing and KOLs

- Omnichannel presence: Both online and offline retail availability

- Competitive pricing: Offering value within local purchasing power

Future Outlook and Market Convergence

Opportunities for Cross-Market Learning

What Spacegoods Could Learn from China:

- Distribution diversity: Expanding beyond DTC to strategic retail partnerships

- Format innovation: Developing convenient single-serve options

- Cultural adaptation: Framing benefits in locally resonant terms

- Price segmentation: Offering entry-level products alongside premium lines

What Chinese Brands Could Learn from Spacegoods:

- Ingredient transparency: Detailed disclosure builds trust with educated consumers

- Community building: Creating engaged customer communities, not just transactions

- Clinical validation: Investing in research to substantiate claims

- Subscription economics: Building predictable revenue through recurring purchases

Potential Market Shifts

Increased Convergence: As Chinese consumers become more familiar with Western functional ingredients (mushrooms, adaptogens) and Western consumers explore TCM concepts, product formulations may begin to merge.

Regulatory Evolution: Both markets likely face stricter oversight as the category grows, potentially favoring established players with compliance resources.

Scientific Validation: Brands investing in clinical trials and peer-reviewed research will gain competitive advantages as consumers demand evidence.

Personalization: Both markets may move toward customized formulations based on genetic testing, sleep data, or cognitive assessments.

Conclusion: A Global Movement with Local Flavors

Spacegoods and its Chinese counterparts are participating in the same global trend—the desire for functional beverages that deliver health benefits beyond basic nutrition or caffeine stimulation. However, their approaches reflect distinct cultural contexts, consumer preferences, and market infrastructures.

Neither market holds inherent advantages; each has developed strategies optimized for local conditions. Spacegoods excels at community building and ingredient transparency, while Chinese brands demonstrate superior distribution capabilities and cultural integration.

The future likely belongs to brands that can balance scientific rigor with cultural relevance, premium quality with accessibility, and innovation with trust. Whether that means Western brands expanding eastward, Chinese brands moving west, or entirely new players emerging, the functional beverage revolution is just beginning.

For consumers, this competition drives better products, more research, and greater choices. For entrepreneurs and investors, it represents one of the most dynamic and promising sectors in the health and wellness industry.